Thank you for choosing to support UMass Chan Medical School

Your gift will make a difference in the health and well-being of the people of the commonwealth and beyond. Many giving options are available:

Planned Giving

There are ways to make an important gift commitment without letting go of your assets today. A planned gift option might be the right fit for your personal planning. Learn more

Alumni and Parent Giving

Alumni and parent giving supports needs and programs that help UMass Chan Medical School move medicine forward. Here's how.

New reasons to give

New laws that were introduced in 2023, along with other changes, may affect your giving decisions.

A new incentive for Massachusetts taxpayers to give

On Jan. 1, 2023, Massachusetts revived its charitable contribution deduction. If you are a Massachusetts taxpayer, every charitable donation you make can be deducted from your state income tax return.

Secure 2.0 retirement changes may affect your saving and your giving

A new law creates a new opportunity to use retirement assets to make charitable donations. What does this law mean for you? Let’s take a look at some of the key provisions.

Highest rates in 16 years: The amazing benefits of the charitable gift annuity

Charitable gift annuity rates have gone up yet again, making the payouts you’d receive the highest in 16 years. Get the details so you can lock in these great rates and get fixed, reliable income for life.

A new Mass. tax could impact your planning

In November 2022, Massachusetts voters approved an amendment to the state constitution that creates a 4 percent surtax on annual income over $1 million. This “millionaire tax” is effective beginning in the 2023 tax year. Generally, income that is currently subject to the Massachusetts 5 percent flat income tax is subject to the new surtax.

Keep in mind that a gift to UMass Chan can provide a charitable deduction that lowers both state and federal income taxes. Consult your advisors, and please let us know if we can help you explore gift planning options and benefits.

How to Give

The UMass Chan Medical School Foundation, a 501(c)(3) organization, is the legal entity through which donors financially support UMass Chan Medical School, Inc. The tax ID number is 04-3108190.

Credit card

Through our secure online giving form or we would be happy to assist you by phone at 508-856-5615.

Check

To make your gift by check, please make it payable to the UMass Chan Medical School Foundation - [fund name] and mail to:

UMass Chan Medical School

Office of Advancement

333 South Street

Shrewsbury, MA 01545

Other ways to donate

Tribute giving

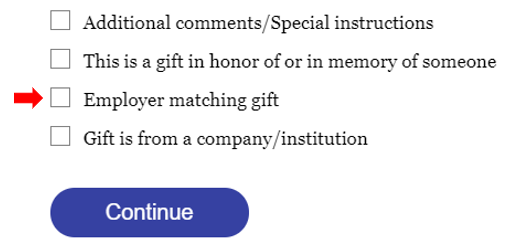

Your gift may be made in memory or in honor of someone special. If you are making your gift online, there’s an area on our online giving form to note this; you can also tell us in writing if you submit a check. We’ve written some sample language that can be used for an obituary.

Matching gifts

Many employers will match employee charitable contributions, which can double the impact of your gift. If using our online giving form, please check the appropriate box. Contact your Human Resources Department for a matching gift form from your employer and send us a completed copy. We will do the rest.

Planned giving

There are ways to make an important gift commitment without letting go of your assets today. A planned gift option might be the right fit for your personal planning. Learn more.

Payroll deduction - UMass Chan employees

UMass Chan Medical School employees can make charitable donations to the school through payroll deduction. Please contact the Office of Advancement to learn more: 508-856-5524, giving@umassmed.edu.

Donor advised funds

A donor advised fund (DAF), which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to UMass Chan Medical School.

Through your DAF you can recommend a grant to UMass Chan Medical School to support ___________________. The legal name to use is UMass Chan Medical School Foundation, Inc., and the tax ID number is 04-3108190.

Do you have a donor-advised fund (DAF) through Fidelity, Schwab or BNY Mellon? Give directly to UMass Chan via the DAF Direct website.